Inr compound interest calculator

To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of. What is Compound Interest.

The Simple Interest Formula Simple Interest Simple Interest Math Word Problem Worksheets

SBI sells KSK Mahanadi Power loan account to Aditya Birla ARC for Rs.

. T time in years. For the first year we calculate interest as usual. A P 1 rnnt The compound interest formula solves for the future value of your investment A.

The equation used in our INR calculator looks as follows. Range of interest rates above and below the rate set above that you desire to. FV 10000 1 0051 101 10000 1628895 1628895 Answer The value.

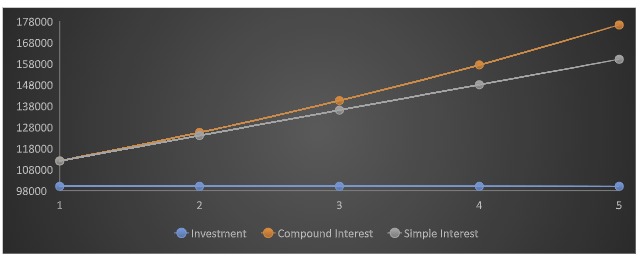

Compound Interest Calculator Compound Interest Formula Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow. 100 10 10 This interest is added to the principal and the sum becomes Dereks required repayment to the bank for that present time. Your estimated annual interest rate.

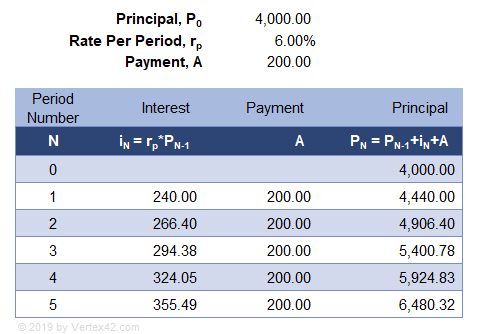

Thus the interest of the second year would come out to. To count it we need to plug in the appropriate numbers into the compound interest formula. Compound interest is calculated using the compound interest formula.

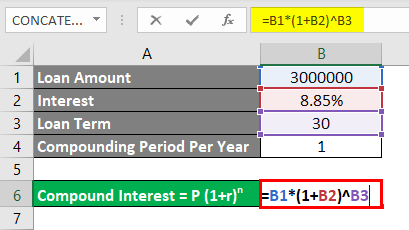

A P 1 rnnt In the formula A Accrued amount principal interest P Principal amount r Annual. You can calculate compound interest using the compound interest calculator formula- A P 1 r100 nt Where A Total amount by the end of the period P Principal amount from which. Interest rate variance range.

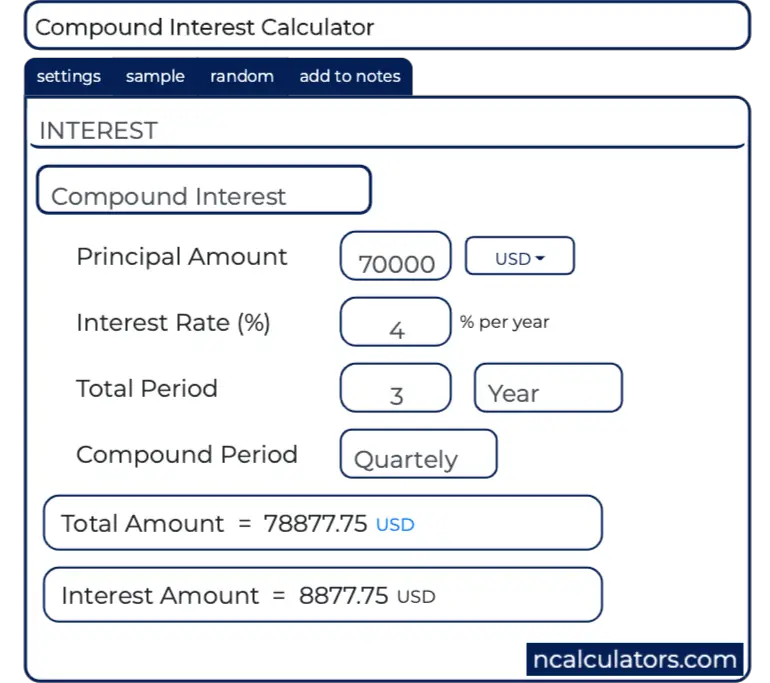

The compound interest formula used in the compound interest calculator is A P 1rn nt A the future value of the investment P the principal investment amount r the compound. Rate of Interest Amount A. How does compound interest work.

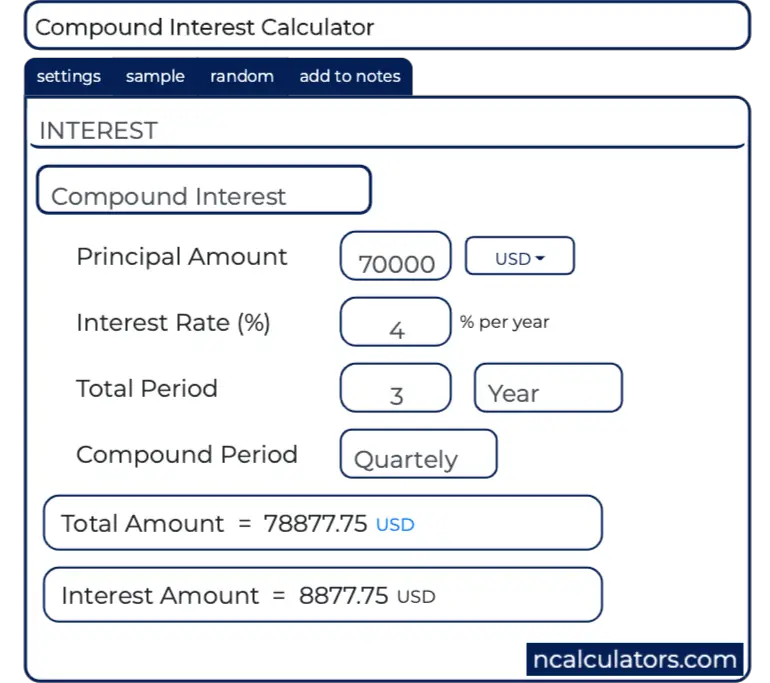

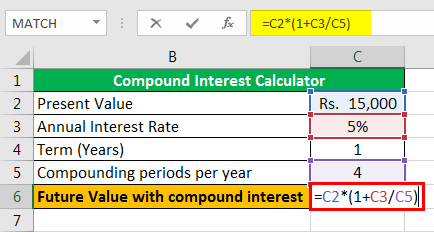

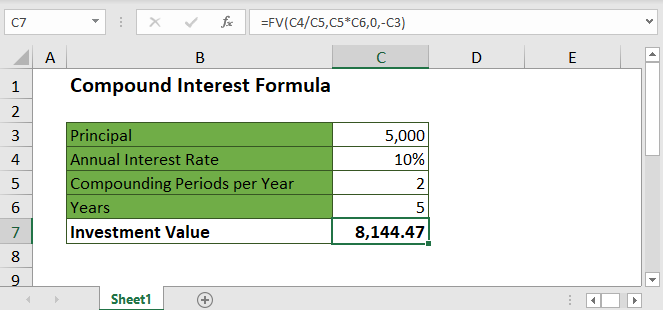

In India banks use quarterly compounding to calculate interest in rupees. You can also use this formula to set up a compound interest calculator in Excel 1. The formula for calculating compound interest is A P 1 rn nt For this formula P is the principal amount r is the rate of interest per annum n denotes the number of times in a year.

If you have availed a loan of Rs. 10 Lakh from a lending institution at an interest rate of 1050 for a tenure of 10 years or 120 months the formula determines that the EMIs payable is Rs 13493. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100.

Get a universal compound interest formula for Excel to calculate interest compounded daily weekly monthly or yearly and use it to create your own Excel compound. The compound interest formula is. Inr compound interest calculator Sabtu 03 September 2022 Edit.

You now earn INR 525 as interest on your new principal amount so you now have a total of 10500 525 11025. If you use the formula above you can quickly understand how much. Check the latest Indian Rupee INR price in Compound COMP.

You can calculate compound interest using the compound interest calculator formula- A P 1 r100 nt. 8th Wonders of the world Formula on Compound Interest Difference between CP and SI. 110 10 1.

Compound Interest Calculator For Daily Monthly Yearly Compounding

Compound Interest Calculator For Excel

How Do I Calculate Compound Interest Using Excel

Daily Compound Interest Formula Calculator Excel Template

Calculate Compound Interest In Excel How To Calculate

Pin On Water Curtain

Compound Interest Ci Formulas Calculator

Compound Interest Calculator Apps On Google Play

Compound Interest Calculator For Excel

How To Calculate Compound Interest In Excel Formula Template

My Opera Is Now Closed Opera Software Currency Design Coin Art Old Coins Value

Compound Interest Ci Formulas Calculator

Google Coins Old Coins World Coins

High Grade Movement Watches Ebay Coins World Coins Coins For Sale

Compound Interest Formula In Excel Step By Step Calculation Examples

Compound Interest Formula In Excel And Google Sheets Automate Excel

Daily Compound Interest Formula Calculator Excel Template